(latest update: Sunday 8 October)

This is a free interactive timeline for readers of 'Rigged' by Andy Verity.

It contains audio recordings that the authorities on both sides of the Atlantic didn’t want you, the public, to hear.

Also embedded are links to copies of emails, confidential documents and contemporaneous news articles that reveal a secret history spanning 16 years: an unsettling true story of a high-level cover-up on both sides of the Atlantic followed by a series of miscarriages of justice in the UK and US.

Much of this evidence has never been shown to Congress nor to the UK Parliament. Some of the most powerful evidence was never put before juries in nine criminal trials in New York and London.

To get to know this story for free, you can listen here to The Lowball Tapes, a BBC Radio 4 investigative podcast series broadcast in 2022 and shortlisted for three awards.

The book, which contains much exclusive information in addition to what is set out below, including the personal stories of traders wrongfully prosecuted for ‘manipulating’ interest rates, can be purchased here.

This is the latest of many updates to this timeline to be published in the coming weeks, eventually bringing it right up to the present day. The new material is at the bottom of the timeline, this time covering the crucial bailout week of 8-15 October - and all that went on then that central banks cross the world knew about - but didn’t tell the public. I’m open to any comments on it from any source, either here on Substack or via direct message to my Twitter account. I’ll also update it if I learn something editorially relevant and new to me.

Click on the links and the embedded audio below to see and hear evidence of the cover-up, followed by what prosecuted traders and brokers say was a stitch-up.

Could that be true?

You be the judge:

1969

To set interest rates on large loans, Greek banker Minos Zombanakis invents a formula that reflects banks’ shifting cost of funds. The first is an $80m loan to the Shah of Iran.

1970s

The formula, now named ‘Libor’ (the London Interbank Offered Rate) is used with increasing frequency to set interest rates for large offshore loans in US dollars.

January 1986

In response to a Bank of England request, the British Bankers Association (BBA) launches the brand ‘BBA Libor’. It issues instructions to 16 banks to publish a daily estimate of what interest rate they would pay to borrow a large sum of cash from other banks.

1986 to 2012

Traders on the cash desks of 16 banks on the Libor ‘panel’ answer the Libor question each working day: at what interest rate could they borrow cash in reasonable size at 11am?

They select the rate they will publish from the narrow range of interest rates on offer in the market at which they could borrow cash (eg money brokers tell them there are offers at 3.43%, 3.45% and 3.44%; they publish any one of those three).

With nothing to choose between that range of accurate answers to the Libor question, traders on cash desks check each day with colleagues on derivatives desks (who trade financial instruments that go up or down in price linked to Libor) whether they would prefer Libor high or low. That way the rate they select will be in keeping with a key part of their jobs - to do everything with their bank’s commercial interests in mind.

Traders in derivatives linked to Libor routinely ask their cash desk colleagues to quote their banks’ Libor estimates ‘high’ or ‘low’ to suit their bank’s commercial interests (eg trading positions):

December 1998

Euribor, the Euro Interbank Offered Rate, is published for the first time. Its founders are Helmut Konrad, then president of ACI Germany, a financial markets organisation of foreign exchange and money market traders; Jean Pierre Ravisé, president of ACI France; and Nikolaus Bömcke, then secretary general of the industry body the European Banking Federation, who drafts the code of conduct.

18 August 2005

The BBA’s John Ewan tells senior Bank of England officials of daily commercial influence on Libor. Libor is ‘some 3 to 4 basis points over the actual market rate as it’s in the interests of banks to have a higher Libor’. (No-one falls off their chair.)

17 July 2007

Bear Stearns discloses that two hedge funds investing in US subprime mortgages have lost nearly all of their value.

20 July 2007

US Federal Reserve chair Ben Bernanke tells Congress that the amount of money lost on US sub-prime mortgages that aren’t being repaid could be up to $100bn.

9 August 2007

BNP Paribas announces it is freezing three hedge funds that specialised in US mortgage debt, indicating it has no way of valuing its mortgage investments. Credit crunch begins.

August 2007 - October 2009

Banks continually post Libor rates much too low to reflect the real cost of borrowing cash: lowballing.

10 August 2007

The huge, unknown scale of US mortgage losses has made banks reluctant to lend money to other banks for fear they might not get it back. Clive Jones of Lloyds tells BBA’s John Ewan no Libor is based on the definition as there are no cash offers in the market. Has the Bank of England spoken to the BBA about it?

Ewan consults other practitioners on the body that runs Libor, the Foreign Exchange and Money Markets Committee and comes back to Jones. Jones tells Ewan that Lloyds’s Libor isn’t real.

14 August 2007

German bank Landesbank Hessen-Thuringen Girosentrale tells the Bank of England Libors are ‘totally distorted, 25-30 bps away from where they should be’.

BoE’s Paul Tucker calls senior bankers from RBS, Barclays, HSBC, Lloyds and HBOS to a confidential meeting. They agree Libor fixings are too low and there’s a case for raising them considerably higher. In the next two days, banks hike rates by 20-25 basis points.

16 August 2007

The committee than runs Libor, the Foreign Exchange and Money Markets Committee discusses how banks can’t set Libor properly because there are no offers to lend cash.

20 August 2007

German bank Landesbank Baden-Wurttemberg tells the Bank of England it believes banks are manipulating Libor.

Barclays head of European Collateralised Debt Obligations (investments linked to US subprime mortgages) Ed Cahill resigns.

22 August 2007

Deutsche Bank warns the Bank of England that other banks are setting Libor ‘artificially low to allay market concerns’ – a practice later called ‘lowballing’.

Standard & Poor’s slashes credit ratings for two ‘structured investment vehicles’ exposed to US mortgages created by Barclays and places a third on review.

28 August 2007

Returning from holiday, Peter Johnson notices US dollar Libors are too low and corrects his rate upwards. He sends an email, ‘Draw your own conclusions about why people are going for unrealistically low Libors’, forwarded the same day to the New York Fed. (In July 2012, the email is released after Barclays Legal has redacted it, removing Johnson’s name).

29-31 August 2007

Barclays bosses Jerry del Missier, Bob Diamond and John Varley discuss negative media speculation about Barclays’ financial state with Paul Tucker, who tells Diamond that Barclays is above the market on Libor. “AAAARRRRRGGGGHHH!!!’ says Diamond privately.

31 August 2007

Financial Times article ‘Anxious Market Catches Barclays Short of £1.6bn’.

1 September 2007

The last date of the indictment period covering the ‘conspiracy to defraud’ by Barclays traders as alleged at trial by the Serious Fraud Office (1 January 2005 -1 September 2007)

1 September 2007

In a Saturday phone call Tucker tells del Missier ‘you should get your Libor rates down’, according to sworn testimony to the US Department of Justice by del Missier.

3 September 2007

Bloomberg report ‘Barclays Takes a Money Market Beating’ suggests Barclays’ higher Libor rates may be further evidence that it’s in financial difficulty.

Peter Johnson (PJ) wants to raise his Libor submission to reflect the higher cost of borrowing but is instructed not to by head of group balance sheet Miles Storey, who’s received an instruction passed down by del Missier. PJ tells a colleague he’s under political pressure from senior managers to understate his Libor estimate.

13-14 September 2007

BBC’s Robert Peston reveals Northern Rock has asked for and been granted emergency liquidity assistance (cash) from the Bank of England, prompting a run on the bank.

20 September 2007

At a Barclays board meeting including then chief executive John Varley and his deputy Bob Diamond it’s agreed that finance director Chris Lucas will take the lead on Libor, with group treasurer Jonathan Stone as a conduit to Dearlove.

21 September 2007

PJ tells the Federal Reserve Bank of New York (‘the New York Fed’) about lowballing, as he tells his New York colleague Ryan Reich later that day:

September 2007 - October 2009

PJ protests other banks’ dishonestly low, inaccurate Libor submissions, trying to post higher, more honest rates. But Storey and Dearlove repeatedly pass down instructions from the board of Barclays not to stand out too far from ‘the pack’ of other banks’ published Libor estimates of the cost of borrowing, meaning he’s also lowballing.

21 November 2007

Barclays group treasurer Jonathan Stone and PJ’s immediate boss Mark Dearlove express relief that PJ’s Libor rates no longer stand out above other banks. Stone tells him he doesn’t want Barclays to have the highest submission – ‘you’ve heard Bob as well. We don’t want to be in the press. It just ain’t worth it.’

29 November 2007

PJ’s boss Mark Dearlove calls Jonathan Stone to an emergency conference call (you can listen in below) with head of balance sheet management Miles Storey, PJ and Colin Bermingham. Fearing a ‘shitstorm’ if PJ posts what he thinks is a fair Libor rate – 5.50% - Dearlove, Stone and Storey instruct PJ to lowball – putting in his Libor estimate for the cost of borrowing dollars over 1 month at 5.30%, twenty basis points below where he thinks it should be. Dearlove tells Stone they need to get a wider audience involved and take the issue ‘upstairs’. (Dearlove, Storey and Stone - who were merely carrying out the directions of the board - have been offered the chance to comment but have not responded; Barclays declined to comment on this evidence).

Soon after the call, Storey calls Ewan to try to get the BBA to do something about lowballing, saying, ‘manipulation, for whatever reason, is going to come out.’ He also warns it would be wrong for banks to decide to raise rates together because' ‘that would be just as bad the other way round’.

Later, PJ fulminates to Barclays swaps trader Ryan Reich in New York. (Strong language alert - not for young ears):

30 November 2007

Miles Storey passes on Chris Lucas’s direction that Barclays should not be ‘outside the top end’ of other banks’ Libor submissions, meaning PJ will be posting false Libors.

4 December 07

PJ tells Dearlove that his Libor estimates are ‘a load of bollocks’ and he wants to take a stand. He writes an email for Dearlove to forward. ‘My worry is that we (both Barclays and the contributor bank panel) are being seen to be contributing patently false rates. We are therefore being dishonest by definition...Can we discuss urgently please?” He later says the same thing to Ryan Reich in New York.

5 December 07

Jon Stone says Lucas has told him he doesn’t ‘see the benefit’ of raising Barclays’ Libor submissions to a more accurate level. Dearlove speaks to Barclays compliance director Stephen Morse. ‘I don’t think it’s fair on PJ to be setting something which he knows is wrong’.

After Dearlove raises the issue with Diamond’s lieutenant Rich Ricci, Morse discusses lowballing with the UK watchdog the Financial Services Authority (FSA).

September 2007 - May 2009

The Bank of England, New York Fed, UK Treasury, Financial Services Authority and the British Bankers Association are told repeatedly by Barclays and others Libor is too low to reflect the real cost of borrowing cash and that banks are understating Libor rates to avoid speculation they are in financial trouble. Concerns communicated from commercial banks about lowballing, trader requests, manipulation. No moves to contact the police. The FSA is firmly against launching its own investigation.

16 March 2008

After running out of cash, Bear Steans is forced by a run on the bank to sell itself to JP Morgan Chase at a fire-sale price of $2 per share, with the Federal Reserve in support. Market in renewed turmoil.

9 April 2008

After complaints from banks not on the panel of Libor contributors, FSA Market Conditions Meeting discusses disconnect between US dollar Libor and cash rates. An FSA supervisor emails colleagues, ‘[the director of the banking sector - Tom Huertas] advised that the BBA will be coming in this afternoon and we will pass on our concerns that USD Libor may be subject to “manipulation”. Official sends note saying concerns have been recognised and escalated. However, an FSA internal audit team investigating this in 2013 (see p. 43, Communication 32 of this report) finds no record of this meeting.

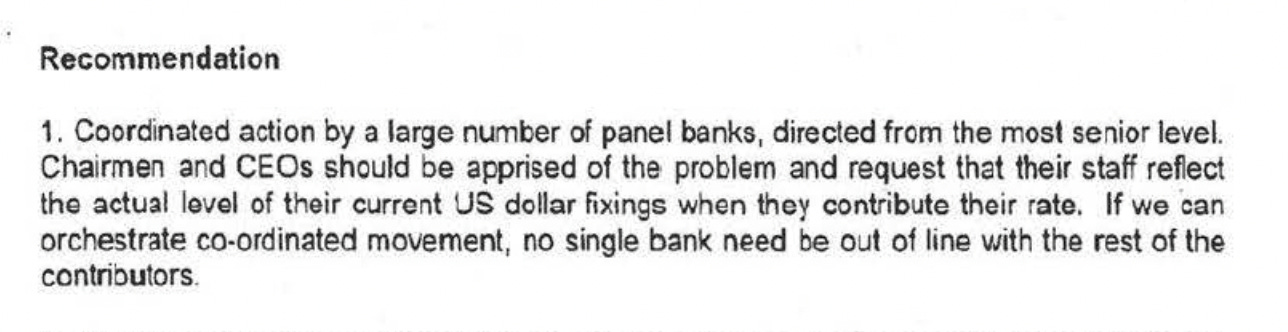

Angela Knight sends memo, originally drafted by John Ewan, to board of BBA outlining lowballing and recommending that the BBA’s board members orchestrate ‘co-ordinated action’, directed ‘from the most senior level’ to raise dollar Libor so it more accurately reflects the interest rates at which cash is changing hands on the money markets.

10 April 08

Bank of England cuts interest rates. But press reports some lenders are raising them.

11 April 08

Colin Bermingham tells NY Fed’s Fabiola Ravazzolo that Barclays is not posting ‘an honest Libor’ in dollars, outlines how if you put your head above the parapet (posting higher, more accurate rates) you get bad press, so banks stay within the pack (lowballing). Fed reports it to US Treasury. A transcript of the call is released in July 2012 after Barclays Legal has redacted Bermingham’s name.

15 April 08

NY Fed speaks to BBA about lowballing. UK prime minister Gordon Brown urges banks to pass on rate cut. Media reports that ‘the price banks charge each other to lend money – known as Libor – remained stubbornly high’.

16 April 08

The Wall Street Journal publishes an exposé by Carrick Mollencamp, ‘Bankers Cast Doubt on Key Rate Amid Crisis’, alluding to banks ‘fibbing’ in their Libor rates.

BBA Board meets, chaired by HSBC global boss Stephen Green, and discusses Angela Knight’s memo. Ewan tells Miles Storey on the phone afterwards that all the board members agreed that lowballing is ‘best dealt with quietly’ and that board members should ‘have a word with the people who quote the rates’ to see if they can float the dollar Libor rate up. Storey asks Ewan what steps have been taken to avoid ‘collusion’ – ie an illegal price-fixing cartel. Ewan says they haven’t got that far. Storey suggests avoiding involving chairman and chief executives. Ewan reveals that’s who the board members are.

BBA announces that it is bringing forward its annual review of LIBOR fixings. Indicating it’s fully aware of lowballing, a Bank of England market conditions update reports: ‘the BBA asserted it could ban any member deliberately misquoting […] This was mainly thought to be aimed at European banks understating their US$ fixings, given they did not want to publicly acknowledge their higher bidding rates’.

17 April 2008

John Ewan returns call from Clive Jones of Lloyds about media reports of the BBA saying it could ban banks who misquote from the panel of Libor contributing banks. Ewan reassures Jones the BBA’s been misquoted.

Soon after his call with Ewan, Jones returns a call from Jonathan Wood of HSBC, saying HSBC is going to be raising its dollar Libor rates (its estimates of the cost of borrowing dollars over 9 and 12 months) and ‘it would be nice if somebody else would come to the party’. Jones isn’t sure; what if the BBA retract their report about removing banks from the panel? Wood says they can’t retract it because ‘I read the Board paper, mate...the BBA Board yesterday afternoon…I briefed our boss on the Board paper.’ That means Angela Knight’s memo. ‘I’ll speak to the dollar guys and then I’ll give you a callback shortly,’ says Jones.

Less than twenty minutes later, after speaking to the guys on the Lloyds dollar cash desk, Jones calls HSBC again. The phone’s picked up by a colleague of Wood’s. Jones tell him they’re not going to raise their dollar Libor estimates quite as quickly as Wood was suggesting. But they will raise them more than they were planning to before Wood called.

The same day, Miles Storey tells two FSA officials about lowballing - and the commercial reasons why Barclays is ‘guilty of being part of the pack’ (of banks that are lowballing, posting false, low estimates of the cost of borrowing dollars). , ‘We did stick our head above the parapet last year, got it shot off, and put it back down again. So, to the extent that the LIBORS have been understated, are we guilty of being a part of the pack? You could say we are. We’ve always been at the top and therefore one of the four banks that’s been eliminated. Um, so I would sort of express us maybe as not clean clean, but clean in principle.’

22 April 2008

The US watchdog the Commodity Futures Trading Commission contacts FSA staff after seeing reports of ‘possible false reporting of information to the BBA’. FSA officials discuss how they aren’t sure they have jurisdiction over Libor.

25 April 2008

BBA ‘chief executives’ meeting (governor’s advisory group) at the Bank of England, attended by John Varley of Barclays, Johnny Cameron of RBS, Nathan Bostock of Abbey National, plus senior BBA and BoE officials including Bank of England deputy governor John Gieve, Paul Tucker and future governor Andrew Bailey. Angela Knight tells them of the NY Fed’s interest in Libor. Knight confirms that BBA staff had been dispatched to the US to placate investors following the spike in dollar libors following the BBA’s intervention on 16 April. BBA later reports that ‘the BoE did not want the libor boat to be rocked when markets are so sensitive and asked what if anything could be done by them to be supportive’.

22 May 2008

Paul Tucker and others receive internal confidential memo about Libor saying, ‘Even before the money market stress, some market participants complained that Libor did not necessarily reflect where banks were actually funding. Since August 2007, this problem has become ever more severe’.

3 July 2008

In response to the BBA Libor review, Fred Sturm of the Chicago Merchantile Exchange, one of the world’s biggest users of the Libor fixings, highlights how submitters of Libor rates are choosing their answer to the Libor question, ‘At what rate could you borrow at 11am?’ from a range of accurate figures reflecting offers to lend on the money markets. He writes, ‘A Contributor Panelist who can borrow “in reasonable market size” at any one of a wide range of offered rates commits no falsehood if she bases her response to the daily Libor survey upon the lowest of these (or the highest, or any other arbitrary selection from among them).’ This evidence is later kept out of some Libor trials.

15 September 2008

US Treasury secretary Hank Paulson decides against bailing out Lehman Brothers and allows it to collapse. Markets go into a tailspin.

18 September 2008

As the crisis intensifies, Peter Johnson tells Ryan Reich, ‘I came in at five this morning and it was Armageddon […] It’s really fucking serious. Yesterday I had the Bank of England talking to me at 7.30 saying, “what’s going on?” I said, “You’ve got a real problem,” – because it really felt this morning as if someone was going to go under today. It really felt bad […] I’ve got to say, Ryan, that Libors are still fucked, mate […] the thing is, there are no offers out there.’

8 October 2008

Gordon Brown announces £50bn to recapitalise stricken banks. Six central banks (BoE, Fed, ECB, plus central banks of Canada, Sweden and Switzerland) announce co-ordinated cuts in official interest rates. Commentators say unless the real cost of borrowing down comes down – as measured by Libor and Euribor – it won’t help to ease the credit crunch.

8-13 October 2008

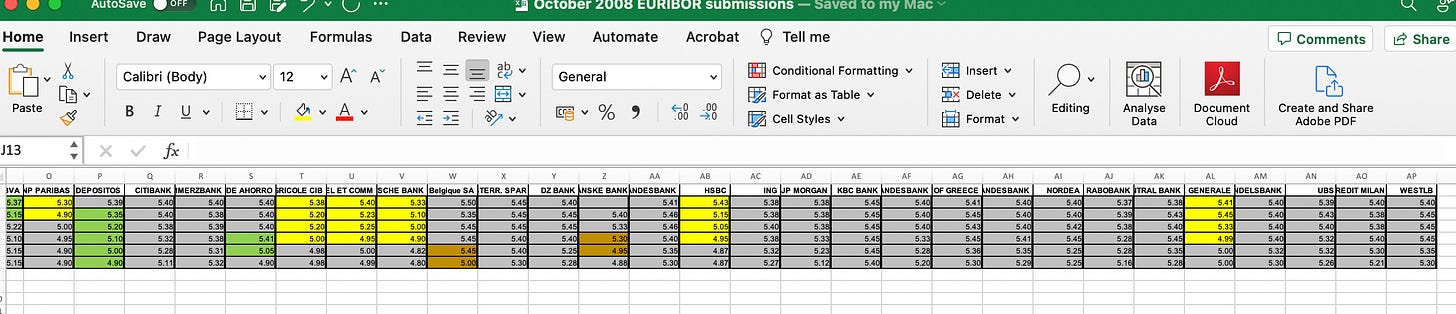

French banks drop Euribor submissions (estimates of the interest rates they’ll have to pay to borrow euros) by record amounts, more than after Sep 11, 2001, without any market development to justify it. Other banks in the same market don’t move at all on the same days.

In succeeding days a) Spanish banks and b) Italian banks similarly drop their Euribor rates, some in moves of unusually round numbers eg of 10 basis points (0.10%) each day. (I can’t fit this Excel spreadsheet into one image on this page so I’m showing two overlapping screenshots; those in yellow are the French banks):

10 October 2008

At a brainstorming event with senior ECB and EU officials at Peterson Institute in Washington, ECB rates committee member Lorenzo Bini-Smaghi appeals to banks (including Deutsche, whose chief economist Tom Mayer is attending) to ‘go back to making a market’, according to email from Mayer to senior DB manager. Bundesbank gives similar message to DB’s Frankfurt office.

‘I have been informed that we do all in our power in Germany to revive the money markets. To this end we are calling all our major counter-parties. We hope the OIS-EURIBOR spreads to come in [ie for Euribor to come down] next week,’ writes Mayer.

This is evidence that banks were co-ordinating to bring Euribor down at the behest of the ECB. The email is forwarded on to top bosses Alan Cloete and Anshu Jain.

Saturday 11 – Sunday 12 October 2008

G7 emergency summit of finance ministers in Washington. ‘Balti weekend’ where RBS and Lloyds/HBOS are forced by govt into part-nationalisations. After Gordon Brown travels to Paris to meet Angela Merkel, Nicolas Sarkozy, EU president Jose-Manuel Barosso and ECB president Jean-Claude Trichet make public statements urging ‘co-ordinated action’.

Much more to come….

Note: this is a work in progress to accompany publication of Rigged. It makes no claim to be comprehensive. If you spot any errors or significant omissions then please do get in touch, either via the contact form on this blog or by DM-ing me on my Twitter account https://twitter.com/andyverity