What the FBI + Gary Gensler's CFTC knew about interest rate manipulation ordered from the top - but didn't tell Congress or the public

Evidence pointing to state-led interest rate manipulation was suppressed by US and UK authorities in agreement with bank lawyers

I’ve just published the latest update of Rigged: you be the judge, the timeline that accompanies the book and exhibits key evidence on which it’s based - audio recordings, documents and emails. This evidence has been known to the authorities on both sides of the Atlantic since 2010 but they have chosen not to publish it.

Embedded in the timeline towards the bottom are extracts from a transcript of an interview conducted by the FBI in November 2010, when Libor whistleblower Peter ‘PJ’ Johnson tells them all about his orders from the UK government and Bank of England to push down Libor artificially. As detailed in Chapter Eight of Rigged, agents from the Commodity Futures Trading Commission, then run by Joe Biden’s appointee as current SEC chair, Gary Gensler, attended the interview and had copies of all the key evidence.

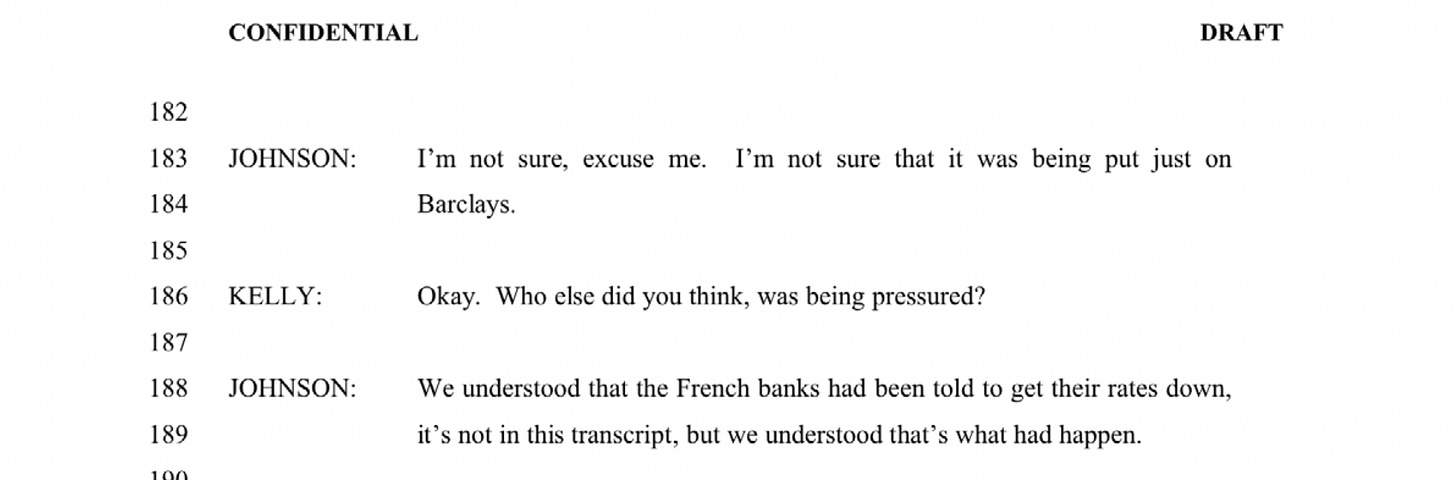

FBI agent Mike Kelly asks PJ about a transcript of the phone call he received on 29 October 2008 from his boss Mark Dearlove, ordering him against his wishes to lower Libor artificially, giving an estimate of the cost of borrowing dollars well below the rate at which he could actually borrow dollars. That order comes from the top of the British state - the UK government and the Bank of England - and it was this very phone call that prompted the CFTC to ask the US Department of Justice to become involved in April 2010. PJ makes it clear to Kelly that it wasn’t just the UK government pressuring Barclays.

PJ also tells them what he’s heard from his colleague and fellow whistleblower Colin Bermingham about the European Central Bank:

PJ also refers to rumours that the Federal Reserve Bank of New York had intervened:

The evidence Johnson gives is backed up by published data on Libor and Euribor submissions from the time. The CFTC, the FBI and prosecutors from the US Department of Justice knew of all this evidence - and Gary Gensler heard the Dearlove-PJ tape evidence pointing to British state involvement in rigging Libor (Gary Gensler has been repeatedly offered the opportunity to comment on his knowledge of this evidence; he has made no attempt to deny or take issue with it).

Yet as Rigged sets out in Chapter Nine, when it came to fining Barclays in 2012, neither the CFTC, nor the DoJ, nor the UK’s Financial Services Authority, mentioned all this evidence pointing to state-led interest rate rigging. The evidence touching on the Bank of England was explained away in the published settlement agreed between the DoJ and Barclays as a ‘misunderstanding’ - an account supported before the UK Parliament both by senior executives at Barclays and Bank of England officials.

The evidence set out in Rigged proves it wasn’t a misunderstanding. The drive to regain control of interest rates in the eye of the storm of the financial crisis, starting in October 2008, led policymakers to pressure commercial banks to lower Libor and Euribor artificially, to a level which had no connection with the real, elevated interest rates at which dollars, euros and pounds were changing hands. That, according to the prosecuted traders, was the real interest rate manipulation - and one far larger than anything they were accused of. But no-one was prosecuted for that. And neither Congress nor Parliament were told.